In a widely-read statement in his annual foundation letter, Bill Gates took an unabashedly optimistic approach to the world this week. Not only did he tout the massive material progress evident everywhere in the world over the past decades, but he also predicted that as more countries accelerate their transformation from rural poverty to urban middle class societies, poverty as we know it will disappear within the next two decades. “By 2035, there will be almost no poor countries left in the world,” Gates wrote. “Almost all countries will be what we now call lower-middle income or richer.”

Few topics have been more fraught than the fate of U.S. manufacturing. The sharp loss of manufacturing jobs since 2008 has triggered legitimate concern that America’s best days may have passed.

Over the past four weeks, we’ve had a run of undeniably good news: the U.S. economic system appears to be on firm ground; more people have the pace of overall activity as measured by GDP is at the highest level in two years. And yet, an aura of unease still seems to hover over us.

After three years of sclerosis, Congress is poised to at last pass an actual budget. We’ve been so consumed with the dysfunction of the parties on Capitol Hill that this feat appears significant. In fact, it should be routine. Yet in the context of the past few years, it is anything but.

In his speech at the Center for American Progress this week, President Obama devoted considerable time to an issue suddenly much in discussion: the minimum wage. This is not a new debate. In fact, it neatly echoes the last time Congress raised the minimum wage, in 2007, which echoed the debates before that.

There’s no doubting that worldwide, kids are out of work. In the United States alone, the unemployment rate for 15 to 24-year-olds is about 16 percent, nearly twice the national average. In parts of Europe, the figures are much worse, with a whopping 56 percent youth unemployment rate in Spain alone — representing about 900,000 people. But do these high numbers represent a global labor market crisis that imperils future growth, as the headlines warn? Maybe not. Maybe instead, they’re evidence of a generation of college graduates determined not to settle, which bodes well for our future.

Twitter's initial public offering last week was everything that Facebook's botched offering a year and a half ago was not: the stock was reasonably priced; management wooed investors; and the company neither promised the moon nor the stars, and was rewarded with a substantial amount of cash raised, a stock that went up more than 75 percent, and a valuation of $25 billion.

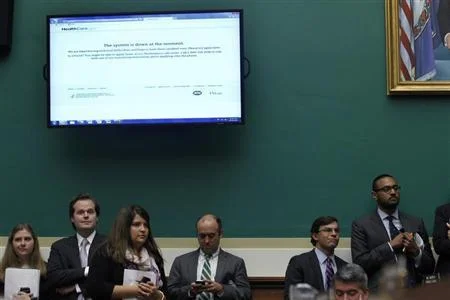

The Obamacare blame game is in full swing, and without other news to fill pages andairtime, it's likely to continue for some time. Attention is shifting from the myriad problems with the official website Healthcare.gov, and toward the health plans that are being canceled, even though President Obama promised that they would not be.

The New York City mayoral race is entering its final days, and it seems all but certain that Bill de Blasio will be the new master of City Hall. That’s prompted anxiety among some in New York, best encapsulated by an ad run by Republican challenger Joseph Lhota warning that the city would revert to a 1970s crime-ridden cesspit if de Blasio is elected.

Before we begin, let it be said that the looming possibility of the U.S.'s default on its own debt is a not-insignificant issue. Let it also be said that the U.S. government may be unwilling to pay interest on its multi-trillion dollar publicly-held debt as of mid-October, and that this carries substantial risks. And, finally, let it be said that this is something we should most definitely avoid.

Washington may once again be careening toward an abyss of its own making. It makes good theater, but for now we don't know how or if it will fundamentally shape our lives. So what will? Half a world away, a Chinese company is considering a public offering.

So the Federal Reserve did not taper after all, as we know from its mini-bombshell of an announcement on September 18th. Having signaled in May and June that the central bank was likely to pare back its monthly purchases of $85 billion in mortgage and treasury bonds, the bank and its chairman Ben Bernanke essentially said “Never mind,” and decided that now was not the time after all.

Reuters Columnist Zachary Karabell looks at what the Fed decision to hold off on tapering says about the dysfunction in Washington.

Five years after the collapse of Lehman Brothers and the onset of the 2008-2009 financial crisis, the U.S. housing market is at last starting to thrive. It has, in fact, been steadily improving over the past years, and that trend has only accelerated of late. Housing is widely perceived as a key ingredient to a healthy economy, and so the revival in the housing market has been heralded as a positive step for an American system that has been sluggish at best. Similar trends in the United Kingdom and parts of the EU are greeted as positives as well.

In 1973, Arthur Schlesinger wrote about the tendency in American history for the president to assume sweeping powers in times of war and crisis. The balance of power established by the Constitution gets upended; Congress and the courts take a back seat; and the executive makes decisions about life and death largely unchecked. He called this "the imperial presidency." Today, with President Obama turning to Congress to endorse a military strike on Syria, the imperial presidency is beginning to wane.

August this year has been exceptionally unkind to the emerging world. We know that Egypt has been plunged into political and economic turmoil, yet that is only the most extreme case. Elsewhere, stories proliferate about economic slowdowns in Peru and China, and protests in Brazil and Turkey (among others).

More than four years ago, President Obama assumed office promising dramatic reform to the housing market. After all, it was the housing market that triggered the financial crisis, and the vast proliferation of low-quality loans that had fueled the housing bubble. But politics delayed those reforms, and now the president is reopening the issue with a call to wind down the two main federal mortgage agencies,

Reuters Columnist Zachary Karabell talks to entrepreneur & New York City mayoral candidate Jack Hidary about how the country's largest city can grow its economy by welcoming tech startups from abroad.

As this week's release of government numbers on unemployment and jobs highlight, the American economy is puttering along in the slow lane. And while few things in life are more frustrating than being stuck in the passenger seat of that car, it certainly beats crashing.

Reuters Columnist Zachary Karabell talks to Mideast expert Richard Bulliett about the future for the Egyptian revolution

The old stock market cliché "sell in May, and go away" had so far proved untrue this year. Instead, it is the bond market, so often perceived as steady, low risk and dependable, that has bitten investors.

Egypt is getting the attention right now but Europe remains a serious concern for the global economy, in part because of high unemployment among the young, says Reuters columnist Zachary Karabell.

Reuters columnist Zachary Karabell explains why Americans are not freaking out over the recent big swings in stocks and bonds.

It came and went like a summer thunderstorm, but unlike meteorological events that inflict actual harm, the sharp gyrations of financial markets exist in their own never-never land of self-fulfilling prophecies and conventional wisdom.

You could be forgiven for missing the latest installment of market panic over the past ten days. It came and went like a summer thunderstorm, passing over the global financial landscape quickly and violently. But unlike meteorological events that inflict actual harm, the sharp gyrations of financial markets have increasingly less relationship to real-world economies and exist in their own never-never land of self-fulfilling prophecies and conventional wisdom.

Forget the NSA's spying program! What really will shape our future is the Fed, according to Reuters Columnist Zachary Karabell. He speaks to former Treasury official David Malpass.

Reuters Columnist Zachary Karabell has the latest on what you should really fear when it comes to other organizations using your data.

This weekend, President Obama and China's new leader Xi Jinping will meet at a retreat outside of Los Angeles. The two men are scheduled to spend six to seven hours covering a range of issues that confront the two countries, from the increasingly fraught issue of hacking and cybersecurity to what to do about an evermore unpredictable and rogue North Korea.

Don't get distracted by whether the Fed will wind down bond buying, according to Reuters Columnist Zachary Karabell. Instead focus on the U.S.- China summit.

Tweets from @ZacharyKarabell

-

RT @BullsBearsFBN: Tonight joining @DavidAsmanfox on @BullsBearsFBN we have @zacharykarabell @caroljsroth @IamJohnBurnett @JCLayfield!… https://t.co/G1QJ6JXJOz

-

Refusing to attend a vote and fleeing the state because you are in the minority and will lose is a cowardly and ant… https://t.co/ERcpjBW3LV

-

RT @BullsBearsFBN: Tonight joining @DavidAsmanfox on @BullsBearsFBN we have @zacharykarabell @JonathanHoenig @lizpeek @GaryKaltbaum! T… https://t.co/CgxAvQLUKi

-

Better to do it themselves: https://t.co/EzKjfcdoJV

-

RT @peterbakernyt: The deal to avert tariffs that Trump announced with great fanfare consists largely of actions that Mexico had alrea… https://t.co/uRqNLD5db5

-

RT @TAS2: Just finished @zacharykarabell's Leading Indicators, and I am so grateful he wrote it. Is it the only book on the h… https://t.co/pYChiS4CxS

-

How much of a threat is dark money? https://t.co/MMOaazckTZ via @nytimes

-

RT @peterbakernyt: As impeachment is debated in DC, check out the history of it from the founders through Johnson, Nixon and Clinton.… https://t.co/e2n7pplfZ5

-

You often need to work w people who revile you and who you don’t like. Nixon and a very hostile congress passed muc… https://t.co/TsvrMOYBnA

-

It was a. Very. Serious. Photo https://t.co/edT9d1k82r

-

Not quite the intended outcome: Trump’s Trade War Is Making Mexico Great https://t.co/ErQ5H6Nski via @politicomag #china #mexico #tariffs

-

About to have what is sure to be a compelling convo w @SSRoachUSChina on China. You can watch live via @techonomy… https://t.co/TFd5fbHvIY

Few topics have been more fraught than the fate of U.S. manufacturing. The sharp loss of manufacturing jobs since 2008 has triggered legitimate concern that America’s best days may have passed.