Over the past week, the coronavirus has gone from an Asian contagion with ripple effects on international supply chains to a global pandemic that will plunge the whole world into recession.

Read moreThe Coronavirus Won’t Be an Economic Catastrophe — Unless We Let it Become One

It would be nice to be able to say when this will settle down, but as the old market cliché goes, no one rings a bell when markets hit a bottom.

Read moreA Stock Market Crash Was Coming, Coronavirus Was Just the Spark

It was the worst week for stocks since the financial crisis in October of 2008. It may get worse still.

Read moreThe U.S.-China Trade Deal Was Not Even a Modest Win

If you detect a note of skepticism already creeping in, it’s because this pseudo-deal deserves not just skepticism but calling out as a dramatic failure of U.S. policy that will have lasting and deleterious effects.

Read moreBest Buy Bucks the Trend That’s Crushing Other Retailers

Far from facing extinction, Best Buy is poised for another year of solid growth. Its relative success stands in sharp contrast to the fate of retail in general, and its formula should serve as a reminder that retailing may be changing, but not everything will be ecommerce.

Read moreDon’t Blame Just Trump for U.S.-China Hostility

The Trump administration, with its fixation on trade balances and its view that the Chinese have ripped off U.S. consumers for decades, clearly initiated the current trade war. But the truth is that American animosity to the rise of China can’t all be attributed to President Donald Trump.

Read moreStumbles at Uber and WeWork Don't Mean the End of Tech

After a long drought, the go-go days of hot technology IPOs appear to be back. The new age began last week with the long-awaited public offering of shares in ride-hailing service Lyft, which raised more than $2 billion for the company with a valuation climbing to over $26 billion before falling back to earth on Monday. To put that in perspective, Lyft’s valuation after the IPO rivaled those of Snapchat, Dropbox, and Spotify; it’s larger than all of this year’s IPOs combined.

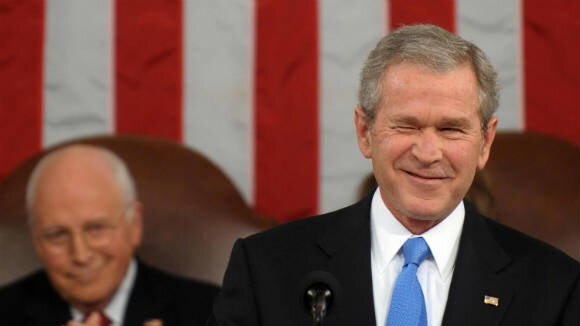

Read moreRating Donald Trump: At least he's not George W. Bush

For those who believe Donal Trump is the worst POTUS ever, let’s stipulate something else: nothing he has done would rank in the top five of what George W. Bush did in the first term of his presidency in terms of sheer, utter, unequivocal harm to the United States.

Read moreStop Saying America’s Problems are Like Ancient Rome’s Decline

What Trump Doesn’t Get About the Chinese Economy

As President Donald Trump escalates his trade war with China, the administration is adamant that China is bearing the brunt of the tariffs. “They’re not hurting anybody [in the United States],” White House trade adviser Peter Navarro said on CNN’s “State of the Union” on Sunday. “They’re hurting China.”

Read moreThe United States will Miss China's Money

Having hundreds of billions of dollars of Chinese investment in the United States was a powerful source of influence that is dwindling rapidly and is in fact shrinking more quickly than bilateral trade. Tariffs can be imposed or lifted almost at the whim of a presidential tweet, but creating a welcoming climate for inward investment takes longer to build.

Read moreReview Essay: The Population Bust

For most of human history, the world’s population grew so slowly that for most people alive, it would have felt static. Between the year 1 and 1700, the human population went from about 200 million to about 600 million; by 1800, it had barely hit one billion. Then, the population exploded…

Read moreListen, Here’s Why the Value of China’s Yuan Really Matters

The China-US trade conflict is taking a more severe turn. President Trump announced a 10 percent tariff on an additional $300 billion of Chinese imports; the Chinese government responded by allowing its currency, the yuan, to fall to more than 7 to the dollar—the lowest in a decade. The US government then formally labeled China a “currency manipulator,” which carries no formal penalty but sets in motion a process that might lead to sanctions by the International Monetary Fund.

Read moreWhy We Should Like Facebook’s Cryptocurrency

The ambition is grand: “Reinvent money. Transform the global economy. So people everywhere can live better lives.” So said Facebook last month in unveiling Libra, its new digital payment service. The company heralded it as “a simple global currency and financial infrastructure that empowers billions of people.” If fully launched, Libra would allow Facebook users to buy and sell goods and services around the world and across borders using a digital cryptocurrency…

Read moreBig Tech Can Stay Ahead of Regulators by Breaking Itself Up

Rumblings about the role of Big Tech in American society have coalesced into a storm long coming, with revelations that the Department of Justice and the Federal Trade Commission are contemplating sweeping antitrust investigations of Facebook, Google, Amazon, and Apple.

Read moreIf China Really Wants to Retaliate, It Will Target Apple

Apple has a Huawei problem. Of the myriad issues raised by the evolving and intensifying US-China trade Cold War, the knock-on effects on Apple have been perhaps least appreciated. And not just Apple, of course, but a slew of American companies that have both shifted production to China over the past two decades and, more vitally, tapped into Chinese middle-class consumers as a source of growth and profits.

Read moreHow Hidden Billions Are Making the Rich Richer

For the British journalist Oliver Bullough, the Paul Manafort trial was simply one more glimpse into a world he calls “Moneyland,” a shadow system of trillions of dollars of hidden assets that transcends nations, feeds corruption and “quietly but effectively” is “impoverishing millions, undermining democracy, helping dictators as they loot their countries.”

Read moreTrump’s Trade War Is Making Mexico Great

When President Donald Trump made good on his promise to be “Tariff Man” this week, he sent economists into a lather, pushed the stock markets onto a wild and largely downward ride, and thrilled parts of his political base, who saw a president finally willing to use his bluntest policy weapon against America’s biggest economic rival.

Read moreThe Last Place Big Tech Wants to Be Is on the Defense

So, it finally happened. A leading American politician has said aloud what many have been whispering: It’s time to break up Big Tech. Democratic presidential candidate Elizabeth Warren just fired the opening salvo and called for the federal government to take action: “Today’s big tech companies have too much power— too much power over our economy, our society, and our democracy.”

Read moreTrump’s Phony Trade War with China

The yearlong China-U.S. trade war now appears to be in its final stages. Tariffs will be lifted, Beijing will promise to buy more American goods and take a harder stance on technology transfers and industrial espionage, and Trump will declare victory — but it will be Pyrrhic, at best.

Read more